Press Release

Aurubis confirms forecast for fiscal year 2018/19 following Q1

Hamburg | Thursday, February 14, 2019

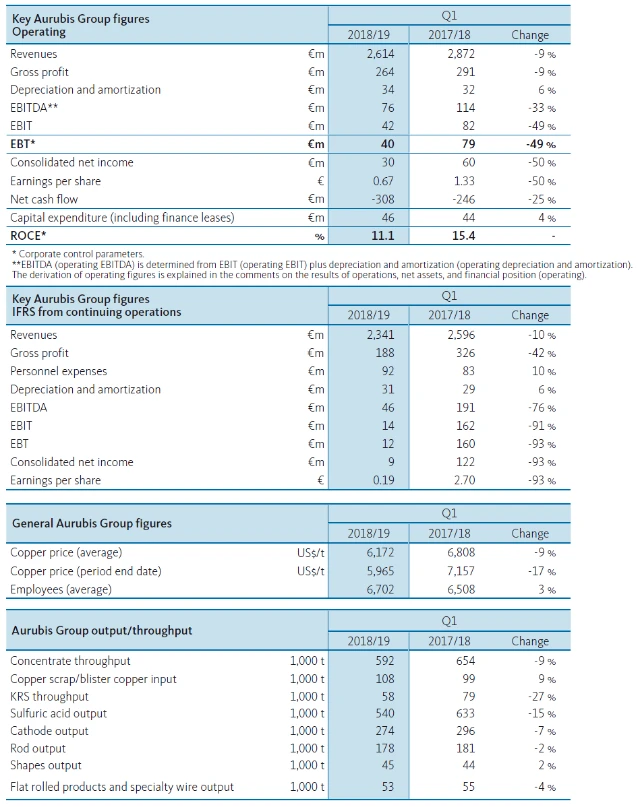

- Operating result of € 40 million (previous year: € 79 million) fulfills market expectations

- Unscheduled shutdowns weigh on result of Q1, which is already weak due to seasonal factors

- Aurubis confirms full-year forecast due to good market environment and positive effects from efficiency improvement program

The Aurubis Group generated operating earnings before taxes (EBT) of € 40 million in the first three months of fiscal year 2018/19 (previous year: € 79 million). The result therefore fulfills the capital market’s expectations.

Compared to the very strong first quarter of the previous year, unscheduled shutdowns at our Hamburg, Pirdop, and Lünen sites had a negative effect of approximately € 25 million on earnings this year. As a result, Aurubis recorded lower throughputs of both copper concentrates and recycling materials. While refining charges for copper scrap were behind the very good levels of the prior-year quarter, they are still satisfactory at levels considerably above the long-term average.

Higher sulfuric acid revenues positively influenced the operating result in Q1. The significantly increased sales prices more than compensated for output volumes, which were lower due to the shutdowns. Sales of copper rod and shapes products remained robust. A good metal gain and positive effects from the efficiency improvement program likewise supported the result.

The Group’s revenues amounted to € 2,614 million (previous year: € 2,872 million) during Q1 2018/19. The change compared to the prior-year quarter is primarily due to the significantly lower copper price and a production-related decline in precious metal sales. Operating ROCE (taking the operating EBIT of the last four quarters into consideration) was 11.1 % (previous year: 15.4 %). The decrease resulted from lower contributions to earnings compared to the previous year, with an increase in capital employed due first and foremost to a build-up of inventories.

IFRS consolidated earnings before taxes (EBT) from continuing operations totaled € 12 million in Q1 (previous year: € 160 million).*

Outlook: Robust market situation and continued efficiency improvements

On the raw material markets, Aurubis expects a good copper concentrate supply and satisfactory treatment and refining charges until the end of the fiscal year. The multi-metal company also expects a fundamentally stable copper scrap market. The current low metal prices could nevertheless lead to a lower copper scrap supply and thus to lower refining charges. However, all of the facilities are already fully supplied at good conditions in Q2 2018/19.

On the product markets, Aurubis expects robust, high demand for copper rod and shapes products. Reduced demand for flat rolled products from the automotive sector, which has been evident since fall 2018, is countered by growth momentum from other market segments, so a satisfactory sales situation can be anticipated in this area in the current fiscal year as well. The sales market for sulfuric acid, which is difficult to forecast, is sending signals pointing to a stable situation with high prices for Q2 2018/19.

For the current fiscal year, Aurubis expects capacity utilization to be slightly below the previous year due to multiple scheduled, legally mandatory maintenance shutdowns at the Lünen and Pirdop sites. This means a lower volume of copper concentrates processed and thus lower cathode output.

Despite the reduced benchmark, Aurubis expects satisfactory treatment and refining charges (TC/RCs) and a good copper concentrate supply in fiscal year 2018/19. Due to its core expertise in processing complex concentrates, the Group regularly achieves TC/RCs above the benchmark.

Aurubis increased the copper premium to US$ 96/t for calendar year 2019 (previous year: US$ 86/t). Because of the stable demand situation on the markets, the company assumes that it will be able to implement this premium for its products for the most part.

Aurubis will continue optimizing all areas of the company with the efficiency improvement program. The target for fiscal year 2018/19 is to achieve an additional € 60 million in project success compared to the base year 2014/15. The Group expects to reach this target.

On February 6, 2019, the European Commission prohibited the intended sale of Segment Flat Rolled Products (FRP) to Wieland-Werke AG. Aurubis can now review other strategic options for FRP.

In light of the Q1 result and the outlook for the rest of the fiscal year, Jürgen Schachler, Aurubis AG Executive Board Chairman, confirms the earlier forecast:

Due to seasonal factors, Aurubis’ first fiscal year quarter tends to be weak. On top of that, there were the unscheduled shutdowns that also had a clear effect on the quarterly result. This led to a distinct decline this quarter compared to the previous year. Nevertheless, we still see a good situation on our markets for the most part, and the impacts of our efficiency improvement program will continue to unfold during the fiscal year. We therefore confirm our forecast and continue to expect moderately lower operating EBT and a slightly lower operating ROCE compared to the previous year.

*Because the IFRS result includes measurement effects due to metal price fluctuations and other factors, Aurubis discloses an operating result (EBT) that differs from the IFRS result. The operating result largely eliminates the effects of metal price fluctuations and thus allows for a more realistic assessment of the business performance. Operating EBT is used for control purposes within the Group.

The segment FRP will continue to be classified as discontinued operations pursuant to IFRS 5. The intended sale of the segment does not affect the operating reporting.

The complete Quarterly Report First 3 Months 2018/19 is available »here«.

Downloads

-

Um die heruntergeladene Komponente zu sehen den QR code scannen

Press Release as PDF

PDF

1 MB